In the following paper, we will try to address a few key points regarding investing in Private Debt funds that focus on the Italian market. Starting from a brief picture of the current Private Debt funds offering, we will position distressed and opportunistic funds.

We will also address the critical point of whether it is possible to achieve and indeed if it is necessary and desirable to seek geographic diversification within a focused distressed and opportunistic private debt fund.

We will then illustrate the reasons why we believe Italy presents such an attractive investment opportunity as this market, for a series of structural reasons, offers the broadest investment options in Europe.

We will conclude that the Italian market represents a unique opportunity in Europe for Private Debt funds. It is underpinned by a massive flow of NPEs, which has increased due to the pandemic. The underlying businesses (real estate, corporations, commercial activities)are true "gems" that can benefit tremendously from a structured investment approach offered by an opportunistic Private Debt fund.

Private debt Funds

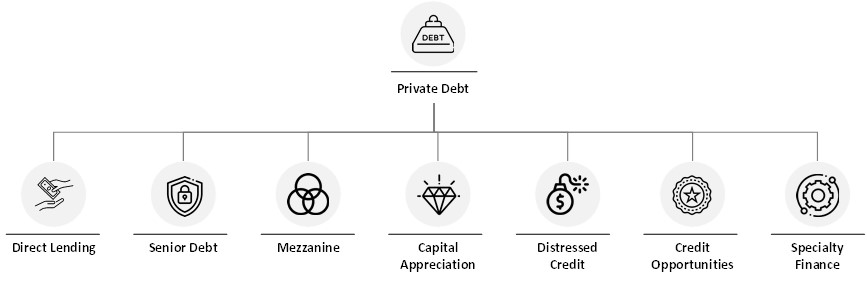

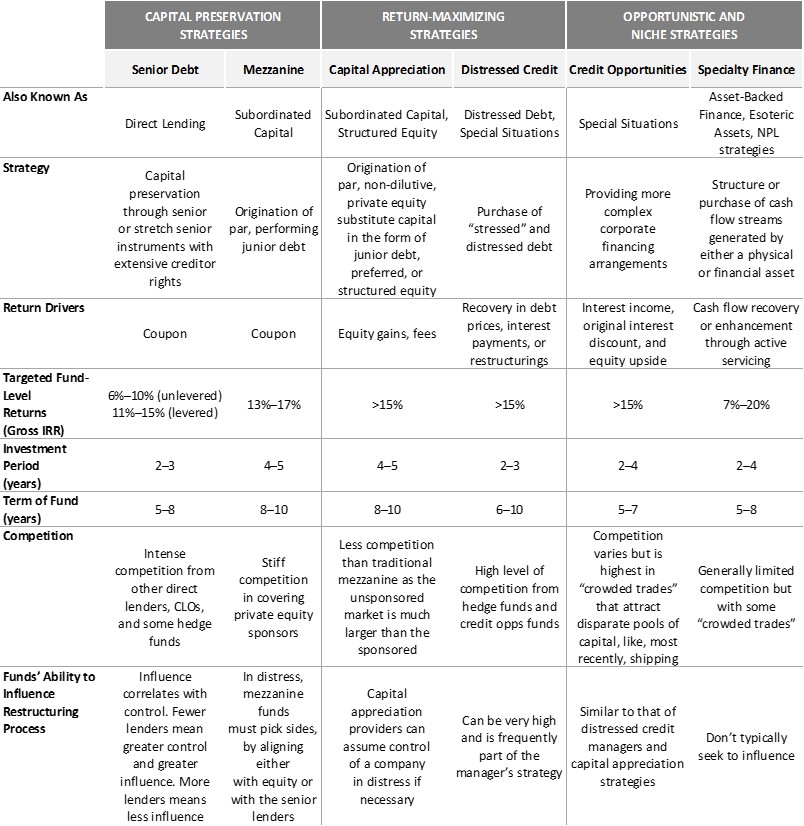

Private Debt funds are a broad umbrella under which many specialities are grouped. Not dissimilar to the broad Private Equity umbrella under which an investor can choose from a multi-dimensional set of funds (venture capital, early-stage, growth, leveraged buy-outs, industry-specific, geographically specific, mega-funds, global funds, local funds, mid-market, small-cap etc. etc.) Private Debt funds also offer a similar variety of choices.

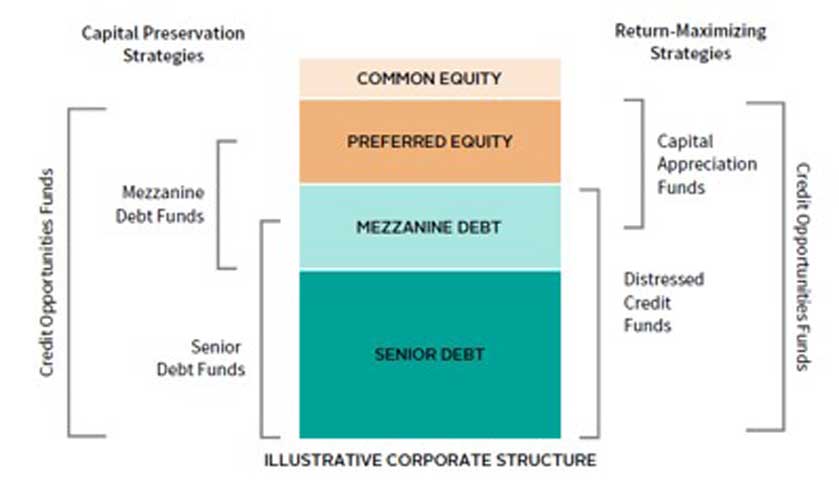

However, Private Debt funds tend to be more often classified based on the investment strategy and less on the geography or industry they focus on. Private Debt funds give investors a more defined choice as to the type of credit risk the manager takes and the part of the capital stack in which the specific fund invests (as per the graph below).

The Private Debt umbrella offers investors several choices and a variety of risk profiles. Below are a simplified graph and table summarising the current offering.

Geographic diversification and why focus is good

Whilst this vertical specialization along types of credit risk might be the norm, there is inevitably some level of geographic specialization also in Private Debt funds.

This is more noticeable in specialized Distressed and Opportunistic strategies where geographic specialization is highly desirable.

These kinds of investment strategies benefit significantly from a thorough understanding of local rules and laws. Local knowledge helps managers select deals that, whilst complex, are still attractive and can offer clear workout paths.

Understanding the creditor bank's needs and having long-standing relations with senior managers in financial institutions and service companies allow the local investment team to better originate and add value to the transactions.

In real estate backed deals, having a deep understanding of local planning regulations and having experience with local authorities helps the investment team manage the process for all stakeholders.

Investing in UTPs, often linked to corporate debt, has an additional level of complexity that requires an even greater awareness of local sensitivities. Companies with UTPs are normally fully operating entities with all the implications that this brings. From the welfare and future of the workforce to ties with the local communities and the supply chain. All this complexity needs to be managed with a deep understating of the local setting.

Negentropy's opinion is that to successfully originate, select, manage and value-enhanced opportunistic, distressed and stressed transactions, it is of the essence to have a strong local presence with long-standing relations and a deep knowledge of all stakeholders.

While our funds offer clients some degree of geographic diversification by investing in deals in other European countries, we pride ourselves on being specialists in the asset class (opportunistic, distressed and stressed private debt) and the Italian market.

Do we, therefore, need geographic diversification at the fund level? Perhaps not since it can be best achieved at the portfolio level.

The fund should instead offer, through deep value investing, a high level of de-coupling from the local market dynamics. Country risk is almost irrelevant since the fund provides clear value and workout paths on each investment.

Opportunities in the Italian Market

Italy is, at the moment, the European country that offers the most significant investment opportunities. It is perhaps the last European market in need of such a high level of deleveraging. Recent European Central Bank data (Source Deloitte: Deleveraging Europe, June 2021) suggests that as most European countries lift their loan moratoria, Non Performing Loans levels could reach € 1.4trillion (€ 200b higher than the previous 2015 peak of € 1.2trillion).

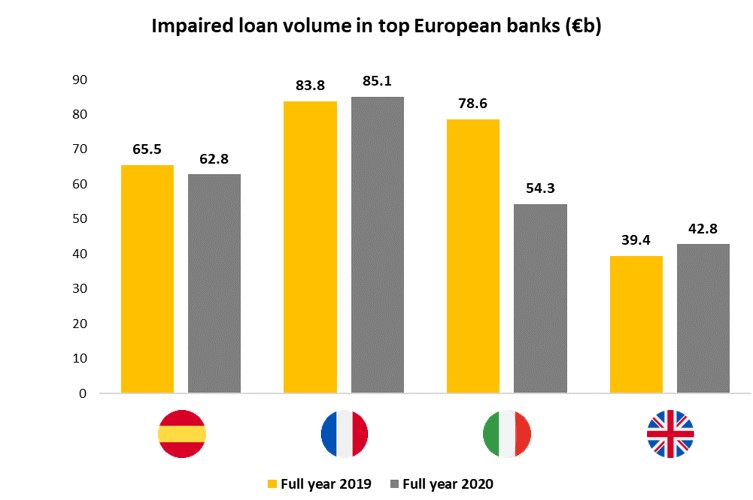

Looking at the European data, it is noticeable how several countries have significant amounts of impaired loans. Italy is among those at the top of the list. However, some countries have dealt differently with the issue.

For example, France made greater provisioning to ensure that the NPL ratio was kept under control. Germany dealt much earlier with the bulk of their NPL stock leaving a low volume of residual NPLs on the bank's balance sheets. Spain's NPL volume in the four largest banks (Santander, Sabadell, BBVA and Caixabank) declined from 2019 to 2020 from € 65.5b to € 62.9b, most of the substantial NPL disposals happened earlier in the decade. In the UK and Ireland, NPL volumes in the four top banks (Barclays, HSBC, Lloyds and Natwest) reached € 42.8b at the end of 2020, up from € 39.4b the year before, but this level of NPEs is a smaller issue than it is in Southern Europe.

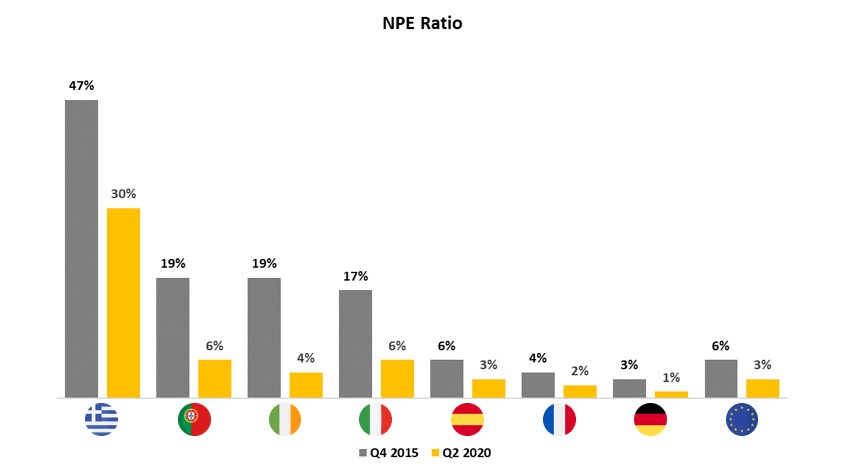

Whilst activity in all the above countries is starting to pick up, driven by the worsening situation brought upon banks by the Covid pandemic, Italy and Greece remain the most active NPL markets (see the table of closed and active deals in 2020).

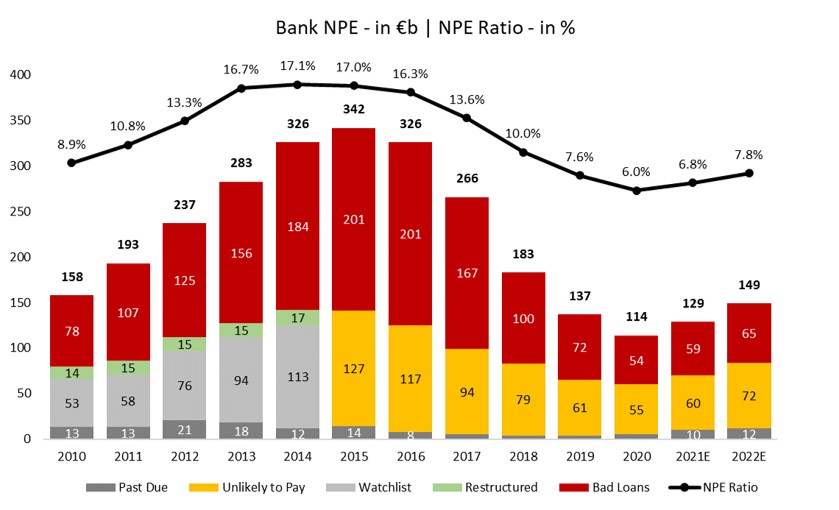

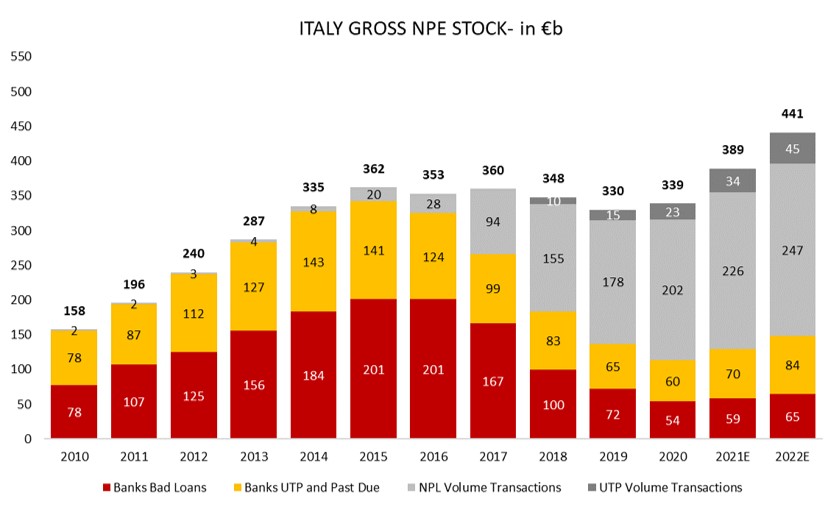

Italian banks represent the largest sellers of NPEs (NPLs and UTPs) as their stock has been among the highest in Europe since 2010. The large sales that occurred since 2015 had a strong positive impact on the overall banking system. Still, the recent pandemic partly reversed these gains (below is a graph summarizing the NPE ratios since 2010 and the composition of the non-performing exposures).

Whilst overall NPEs across Europe have decreased by 52% since the peak of 2015, in mid-2020, Italy still had an above-average NPE ratio.

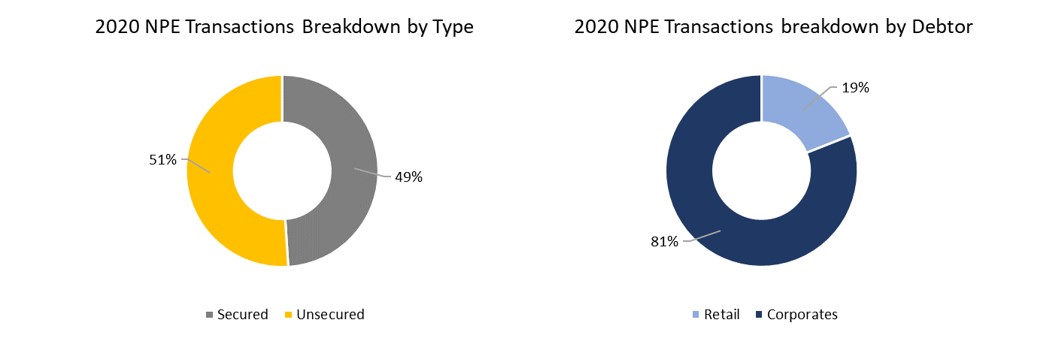

Most of the NPEs owned by Italian banks are linked to corporate debt, and almost half is secured (the vast majority by real estate).

Looking forward, unfortunately, the picture does not look very different for the Italian NPE market. In 2021 and 2022, the expected new NPEs could be as much as €100bn (Source: PWC, The Italian NPL Market - The Calm before the Storm, December 2020). Government intervention coupled with the Next Generation EU (Recovery Plan) loans could help reduce the size of this new wave of NPEs.

The previous chart shows that if Italian banks are to remain on track with their NPE disposal plans, the volume of NPEs that needs to be sold ranges between €220bn in 2021 and €300bn in 2022.

This makes Italy a natural place for distressed, stressed, and opportunistic Private Debt funds to invest in.

Taking our analysis one step further, if we look at the size of the NPE portfolios and the content, Negentropy believes there are many "gems" to discover.

Negentropy does not buy large, statistically-driven portfolios. We instead focus on bilateral, non-competitive and exclusive transactions. This allows us to seek great long-term investment opportunities in real estate, corporations, and small portfolios of unsecured commercial debt.

In the corporate space, for example, between June and October of 2020, 73,000 Italian companies closed down, and of these, 17,000 will not be able to re-start their businesses (Source: ISTAT Q4 2020 report).

Among the most affected sectors is the tourism sector. There is a direct impact on the value of dedicated real estate assets and the fashion "Made in Italy" manufacturing sectors (shoes, eyewear and apparel).

The Real Estate assets linked to NPLs are often prime assets in the hospitality and commercial sub-sectors. Sometimes these assets come with long-dated and high yielding rental contracts. In other cases, the assets require repositioning or development. Negentropy has been able to originate, transform and sell very high-quality real estate assets, and our pipeline is rich in new investment opportunities.

Many of the companies that require support in this transition between the pre and post-Covid times are otherwise healthy and need financial support.

Some companies with UTP debts are solid and resilient but require interventions that range from financial to managerial and strategic. This is to ensure that they are able to survive and thrive. The common denominator is that the smaller companies find it harder to access alternative capital and financing sources.

Whilst the banking system contends with its deleveraging issues and is sometimes unable to extend further credit, distressed and stressed Private Debt investors can provide the necessary means for these companies to resolve the financial crisis.

Negentropy's Special Situations fund also has the necessary tools and experience to support companies to ensure they are able to develop not only from a financial point of view.

Conclusions

The time extension of Government incentives (e.g. favourable taxation on asset-backed vehicles) and guarantees (e.g. the Italian government guarantee program for asset-backed sales - GACS) ensures that there will be even greater activity in the NPE market.

Specialist investment funds such as Negentropy are finding numerous and very attractive opportunities that can only be executed successfully with a local dedicated team and an abundance of country knowledge.

We believe that distressed, stressed, and opportunistic Private Debt funds should offer high visibility of returns, safeguards for tail events, sector, industry and maturity diversification.

Instead, we do not believe that complete geographic diversification can be achieved in a dedicated distressed or opportunistic Private Deb fund unless it has dedicated and experienced teams in each geographic location coupled with an adequate track record.

Finally, we believe Negentropy can offer access to Italy, which at the moment is undoubtedly the largest and most attractive European NPE market.

Our approach is unique in that we focus on bilateral, non-competitive deals on which we are leaders and can carry out full due diligence of the debtor.

We seek to provide new finance whilst ensuring the companies we invest in are able to continue developing as part of a value chain that we seek to enhance.