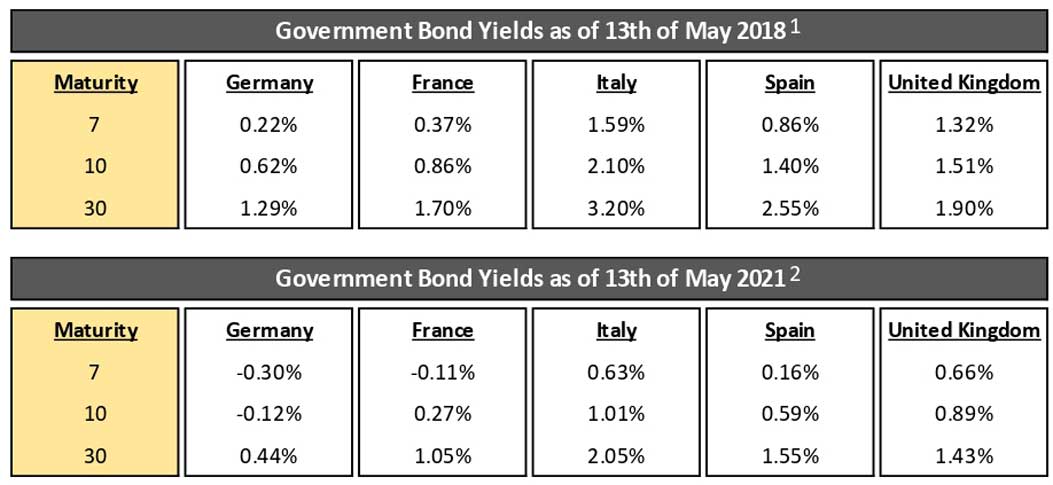

Over the last few years, Government Bonds have soared due to the ECB’s yield compression. This has provided investors with a strong return on Government Bond funds. However, this yield compression, driven by a series of factors that range from macroeconomic issues in Southern Europe to the Covid pandemic, appears to be coming to an end.

In Q1 2021, EU Sovereign Bonds have returned close to zero (Deutsche Bank “Early Morning Reid”, 1 April 2021). In Q1 2021, there has been a sell-off in EU Sovereign Bonds driven by these poor returns and because of investors betting on a more robust economic recovery once the vaccine is rolled out.

It is possible that price appreciations in the Government Bond markets might be, for the time being, limited by the already low interest rates unless the ECB and European countries choose to move to negative rates altogether. Yields remain, therefore, at historical lows.

With this backdrop, we have carried out a simplified analysis of how our Debt Select Fund could play a role in a hypothetical portfolio, replacing part of the Government Bond component of the portfolio.

We are clearly not advocating that an illiquid fund should entirely replace the fixed income component of a well-balanced portfolio.

Instead, we aim to position our Debt Select Fund, or any similar senior private debt fund (that is, a fund that invests exclusively in senior tranches), as a viable alternative to a part of the Government Bond portfolio.

Senior private debt funds invest in such a way that they produce predictable returns from visible cash flows.

Exits and workouts should be equally predictable and sufficiently short-dated to ensure higher predictability of outcomes.

Finally, workout and cashflow estimates should be valued using a sufficiently prudent approach to ensure that the Fund only invests in the lowest possible risk deals.

Our Debt Select Fund returns, on a risk-adjusted basis, compare favourably to the current Government Bond market, and if we accept the assumptions we made regarding the Fund’s standard deviation, it offers a viable alternative in a diversified portfolio.

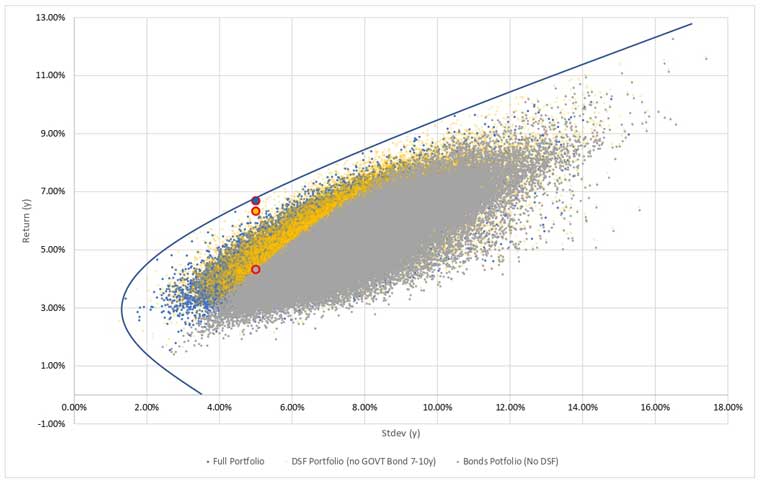

In the graph above, we are illustrating a simulation of an ideal set of portfolios, and we outline the efficient frontier determined by the simulation. We used three portfolios in our simulation:

1. Grey: A balanced portfolio which DOES NOT INCLUDE our Debt Select Fund

2. Yellow: A balanced portfolio that INCLUDES our Debt Select Fund which REPLACES the 7-10Y. Government Bond component (but leaves the 1-3Y and the 15-30Y Government Bonds)

3. Blue: A balanced portfolio which INCLUDES all bond maturities AND our Debt Select Fund

Given a chosen level of standard deviation (X-axis), for example, 5%, the returns offered by the Yellow and Blue portfolios are above the Grey one (see the highlighted red points above).

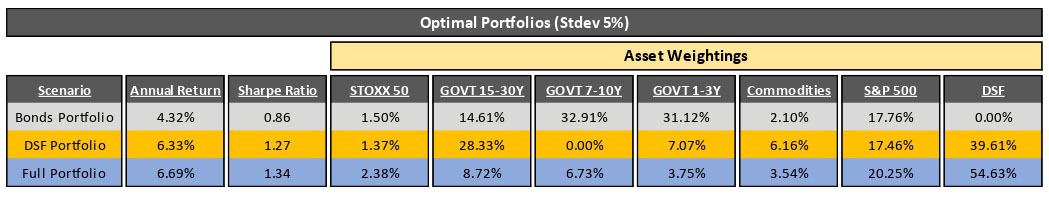

For the same amount of volatility, returns (Y-axis) are more significant for portfolios that include our Debt Select Fund. In the table below, we are illustrating the optimal portfolios given a certain pre-determined level of standard deviation(volatility).

In the table below, we are illustrating the optimal portfolios given a certain pre-determined level of standard deviation(volatility).

Next to the returns, it is also possible to view the portfolios’ Sharpe Ratios and weightings in each asset class.

We recognize that such a high weighting of our Debt Select Fund might be unrealistic due to its illiquidity. However, we believe that the Debt Select Fund plays a vital role in a well-balanced portfolio.

We are assuming that our Debt Select Fund has a standard deviation of 1% for our analysis. This is an estimation that is in turn derived from the contractual and the predicted cash flows of the individual deals the Fund is invested in.

Whilst we accept that volatility could be more significant should the predicted cashflows not occur or differ from our estimations, we are also confident that the expected cash flows are calculated using a sufficiently prudent approach.

Finally, we hope we have provided some helpful analysis that supports senior private debt investments. We believe that in the current European low-rate environment, with the ECB driven yield compression coming to an end and with, potentially, a slow restart of inflation, an uncorrelated senior private debt fund could play an exciting role in a balanced portfolio.

Whilst illiquidity is a clear limit, we believe that the de-coupling of the Debt Select Fund returns from Government Bonds provides an exciting alternative for a portion of a balanced portfolio.