In 2019, the ECB enacted a new law[1] in its ongoing efforts to make the banks in the eurozone more robust. At the time, it was a logical progression of regulations designed to create transparency and appropriate reserve calculation for the lending risks to which a bank is exposed.

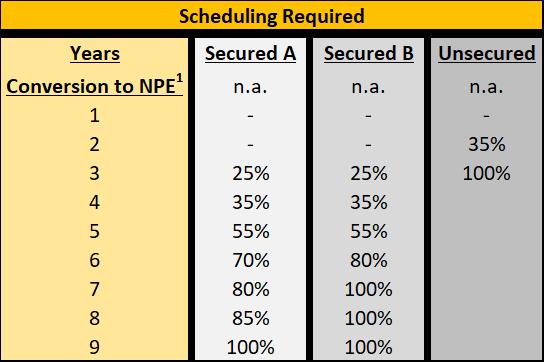

In simple terms, Calendar Provisioning requires banks to provision for, ie: create capital reserves, for any non-performing exposure linked to loans granted from 26 April 2019 onwards. The required coverage ratio increases with the length of time the loan remains impaired.

We are supportive of all efforts to strengthen the fabric of our banking system and Calendar Provisioning is only one part of a broader regulatory framework that aims to ensure that the banking system is stronger and more resilient to shocks. Calendar Provisioning aims at ensuring that banks correctly mark their impaired positions, act more responsibly in their lending practices and adequately monitor their credit portfolios throughout the lifetime of the loans they extend.

The timing of the regulation, however, may have unforeseen consequences for the macroeconomy. At the time Calendar Provisioning was introduced, non-performing exposure on European banks’ balance sheets had been reduced by roughly 50% from the peak levels post 2015[2] . It seemed a reasonable next step to take to further bolster the strength and resilience of the banking system.

However, since 2019 the global economic outlook has changed significantly. Not only have the measures introduced to combat the spread of the Covid 19 virus stifled the Italian budding economic recovery but Eurozone GDP has declined in the wake of the lockdowns.

Small and medium enterprises (SMEs), which are the backbone of the Italian economy, have been particularly negatively affected by restrictions. As the Government support is being withdrawn, many businesses, and SMEs in particular, will face cashflow or capital challenges as they look to recover and rebuild.

It would be reasonable to expect that, as a result of the Covid-induced economic upheaval, some of the loans extended after 26 April 2019 may start to attract capital charges as early as this summer. Unsecured loans attract the most stringent capital requirements, with provisioning that goes to 35% after 2 years of non-performance and to 100% after 3 years.

[1] From the first day of the reference year, i.e. from the last day of the previous year

Source: Pricewaterhouse Coopers Advisory “Calendar provisioning: quali sfide da affrontare” 2019

We believe this will have two main effects:

The first is additional motivation for banks to dispose of their non-performing exposure. As the downward trend in NPE on bank balance sheets is reversed, banks will be more motivated to dispose of their NPE portfolios. In 2021-2022 alone, €40bn to €60bn of non-performing loans are expected to be disposed of by the Italian banking system. Calendar Provisioning adds to the urgency in addressing these exposures.

The second is that it will further constrain lending, in particular unsecured lending. Banks will certainly have implemented more stringent requirements for loan extension to avoid further capital charges as a result of the new provisioning. In Italy, SME’s represent 66.9% of the non-financial business[3] economy. These firms are often served by smaller banks which do not have the capital buffer of larger institutions. The effect of Calendar Provisioning on lending could prove to be particularly severe.

So the question remains whether Calendar Provisioning implemented during the pandemic might not represent a factor that could negatively affect the speed of the economic recovery.

We think it will.

Not only will the overall lending appetite from banks decrease but banks will also prioritise industries with more stable risk-profiles, less sensitive to economic cycles and lenders that offer greater guarantees.

Each of the above elements presents borrowers and banks with significant challenges that are added onto an already complex business backdrop.

Many of the businesses negatively affected by Covid restrictions have strong business models or strong underlying assets, but limited access to loan finance.

This is a great opportunity for investors in private debt to achieve attractive returns while supporting quality businesses.

At Negentropy, we have a track record/history of solving complex borrower situations that result in a win for the investor as well as a win for the borrower. Covid 19 has presented challenges to us all on multiple levels. As we look to return to a level of normalcy and repair the damage that the pandemic has wrought, Private Debt will play an important part in rebuilding the economy.

We at Negentropy look forward to uncovering attractive opportunities for our investors in this unfolding landscape.

[1]Regulation 2019/630 of the European Parliament and of the Council of 17 April 2019 amending Regulation (EU) No 575/2013 as regards “minimum loss coverage for non-performing exposures”.