Over the summer months, I had the chance to re-read "Black Swan: the impact of the highly improbable" by Nassim Nicholas Taleb, a timely read given the very recent and very significant Covid 19 pandemic event.

The book concludes that whilst we try in various fields of human life to predict future outcomes by inferring from the past and using intelligent modelling, in reality, human (and economic) history is driven by unpredictable events (so-called black swans).

I don't entirely buy into the idea that our world is shaped by a series of random, unpredictable and uncorrelated events since this is not what we experience every day in our professional lives. While the author and I disagree on the conclusion, the fundamental thesis made me reflect on market correlations and alpha.

I agree with the author that one-off events have a significantly more significant effect on our lives than they would have had if only we could partly hedge their impact.

The book made me reflect once again, as this is a fundamental question we ask ourselves every time we select an investment. How could black swan events affect our investment funds and, more broadly, how Private Debt funds differ from other strategies.

In the investment process, we always ask ourselves what correlation might exist between our Negentropy private debt funds and broader markets and the economy. We always try to assess how black swan events might affect our investments.

We live under no illusion that we, or any other fund manager, can create an investment portfolio completely insulated from the external world. Nobody operates in a vacuum, and we all, in different ways, invest in the real economy. Therefore it is only natural that we relate what happens in the surrounding world to our portfolio.

Private debt encompasses many opportunities (e.g., senior debt, direct lending, distressed debt, etc.) with different underlying dynamics and risk-return profiles. However, broadly speaking, as an asset class, a private debt fund's performance is primarily driven by the consistency of its underlying cash flow streams.

I will limit the comments that follow to what I know best: asset-based lending funds. At Negentropy, we believe that private debt funds, such as ours, whether they focus on senior lending or distressed / non-performing situations, are more robust if they are backed by tangible assets and cash flow generating businesses. This is our guiding principle. We feel that the higher the weighting towards having an asset as collateral/source of returns, the more the funds will be, to a certain degree, decoupled from market swings, resilient to negative macro trends and somewhat immune from black swan events.

The starting point

When engaged in asset-based lending and investing, particularly when dealing with special situations or distressed debt, fund managers start by evaluating each investment by looking at the worst-case scenario. In fact, in these types of funds, the starting point is often a company, an asset and/or its debt, which has already experienced a "one-off" black swan type event (hence the distress). Whilst the fundamentals remain solid, the event might have caused a particular company to become financially distressed or the situation to become structurally too complex to be untangled through regular channels. Hence, investment managers in this asset class will tend to look at all worst-case scenarios and evaluate the investment based on the worst possible case of a forced liquidation or a fire sale.

By taking a more conservative approach in the valuation of the initial investment, investors can have more confidence in the subsequent lending activity. The prudential approach towards evaluating the asset's ability to generate cash flows helps create the desired natural hedge against market events.

This "defensive" starting point which is unique to complex credit funds, is in itself the first line of defence against unforeseen events and the first way in which the fund can decouple its performance from the broader liquid markets.

Private Debt Income Stream

There is no denying that the correct trade selection and thorough analysis allow investors to assess the stability of the income stream better. However, once the right trade is selected, the objective is to have an income stream that remains constant regardless of other dynamics affecting public markets.

Contrary to public credit investments in which the underlying loan/bond's price movements largely determine the fund's short-term performance (and valuation), private debt funds are driven almost exclusively by the loan repayment element and the related income streams. Given that complex private credit transactions (both distressed or performing) are based on bespoke arrangements between the lender and the borrower, deals are underwritten and subsequently valued in the fund as "held to maturity" assets. Investments are therefore marked and monitored based on the business plan of the investment from the start until maturity.

Each investment has a specific structure, tailor-made to the situation and the underlying collateral and designed to protect the downside and create upside opportunity.

Debt covenants are designed to ensure a suitable balance between the investor's risk profile and the operational freedom for the underlying borrower. In our experience, if we get this balance right, the fund manages to maximize its chances of having stable and sustainable cash flows.

The goal of the investment manager is to invest at a sufficiently conservative entry point that allows for navigation of black swan events and to structure an investment that delivers risk-adjusted returns through a predictable cash flow stream.

In the extreme events in which the borrower could not honour their debt obligations, the distressed fund often has the additional option to take control of the underlying asset (be that a business, a building, inventory or other assets).

In the case of private debt funds operating in senior credit, the fund generates very stable returns despite lending in complex situations. This debt solution provides investors with even greater security as the lending activity is entered into at even more conservative underlying asset valuations. This ensures capital preservation even in the most stressed scenarios.

The predictability and stability of the income stream combined with the optionality to gain exposure to an asset at attractive prices translate into a more stable profile of potential outcomes. For this to be true, the underlying collateral asset must be sound. If this holds, then the ability to own the asset from a low valuation point helps the fund better "ride the storm" and have a better outcome for investors.

Historical and personal perspective

From an investor standpoint, private debt is an established complementary asset class that should be included in all strategic allocations. Historically, it has delivered diversification, stable and predictable income streams, and greater risk-adjusted returns than liquid and traditional debt. In an era of extra-low yields and little room for further yield compression, privately negotiated loans tend to have more favourable terms for the lender compared to more liquid instruments and offer higher returns.

I should also add that private debt has been an essential contributor to economic growth. This is thanks to the growing support it has provided to the real economy, especially since the banks' contributions have somewhat faded after the financial crisis of 2008 due to more stringent regulations.

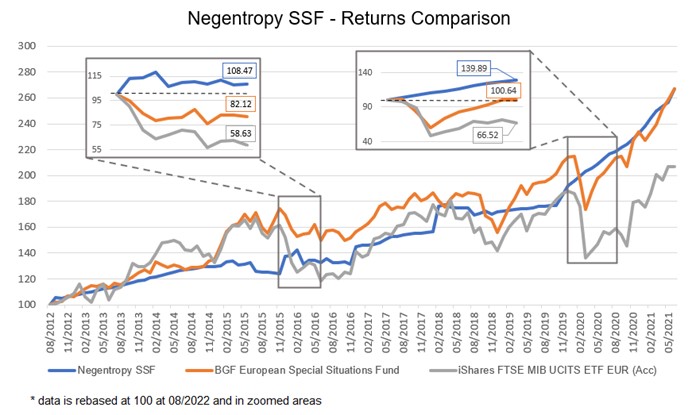

At Negentropy, we have observed that the correlation between our fund returns and market indices is limited over the years.

For this comparison, we have chosen the Italian FTSE MIB as the primary focus of our current portfolio is on investments in Italy. We also selected Blackstone's BGF Special Situations Fund as a benchmark for the sector even though this "index" is broader geographically and strategy-wise than our funds.

In years of strong market corrections (2015 and 2019/2020, for example) whilst the liquid market index was negatively affected by the exogenous shocks, our fund NAV remained solid.

Negentropy's funds benefitted from the stability of the income streams we had managed to harness and from the covenants that governed these loans. Our cashflow based investment approach has repeatedly proved to be robust through market disruption.

NAV stability is also a function of the conservative entry point at which the funds invest.

If the starting valuation is sufficiently low, the investment is well placed to withstand exogenous shocks. If, in addition to this, the investment is underpinned by sound cash flow fundamentals, then the investment has remarkable resilience to shocks and a lack of correlation to traded markets. A fund comprised of such investments delivers steady returns throughout shifts in the credit cycle and throughout periods of market volatility.

The reliability and predictability of the cash flow streams is the hallmark of a well-constructed private debt fund and delivers a steady progression of NAV and returns to investors.

Conclusions

Private debt offers a broad spectrum of investment opportunities with different risk-return and liquidity profiles to match investors' risk-reward targets.

We have chosen to focus on asset-based complex credit as this presents the opportunity to create stable and predictable cash flows.

This combination of asset-backed lending offers:

▪ better downside protection.

▪ less volatility than traditional fixed income.

▪ uncorrelated returns (uncorrelated to liquid credit and equity markets and more immune to black swan events).

▪ reliable income from recurring and predictable cash flows.

▪ portfolio diversification.

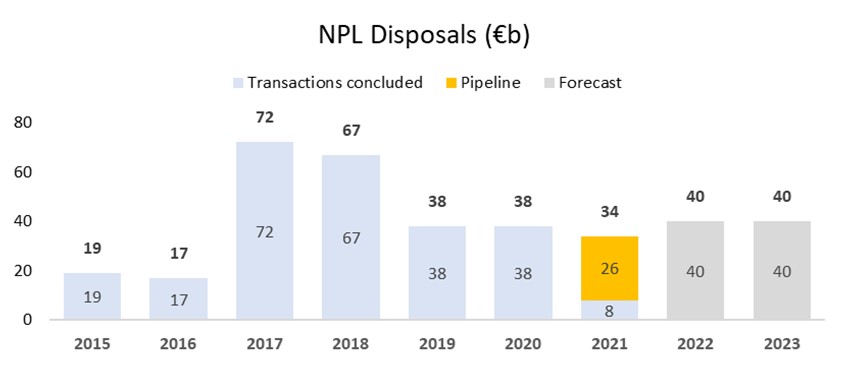

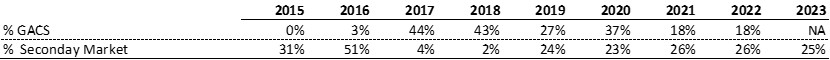

▪ significant opportunities, especially in Italy, from the substantial stock in stressed and distressed debt currently in the financial system.

▪ the opportunity to finance and support the real economy and SMEs.

As much as I enjoyed reading Mr Taleb's book, I must admit I would like to believe that we are not entirely at the mercy of unpredictable events.

Indeed these black swan events have massive and unforeseen impacts on our lives and our investments. However, on the latter, I would argue that we can manage some of our investment risks by seeking un-correlated returns, immune from, or at least significantly less correlated to, such downturns.

We observe a key trend that companies find it harder to operate in the current post-pandemic environment and borrow from the traditional financial system. Many of these companies hold tangible quality assets and benefit from attractive underlying businesses that could support their borrowing activity.

We believe that there is room for private debt funds to participate in this challenging market and that the liquidity provided by debt funds will be even more critical going forward.

Whilst we cannot build portfolios entirely immune from shocks or completely decoupled from the broader market and economy, we believe that Private Debt, in particular asset-based lending, can offer investors a robust solution if they are looking for uncorrelated returns and predictable cash flows that generate attractive returns.